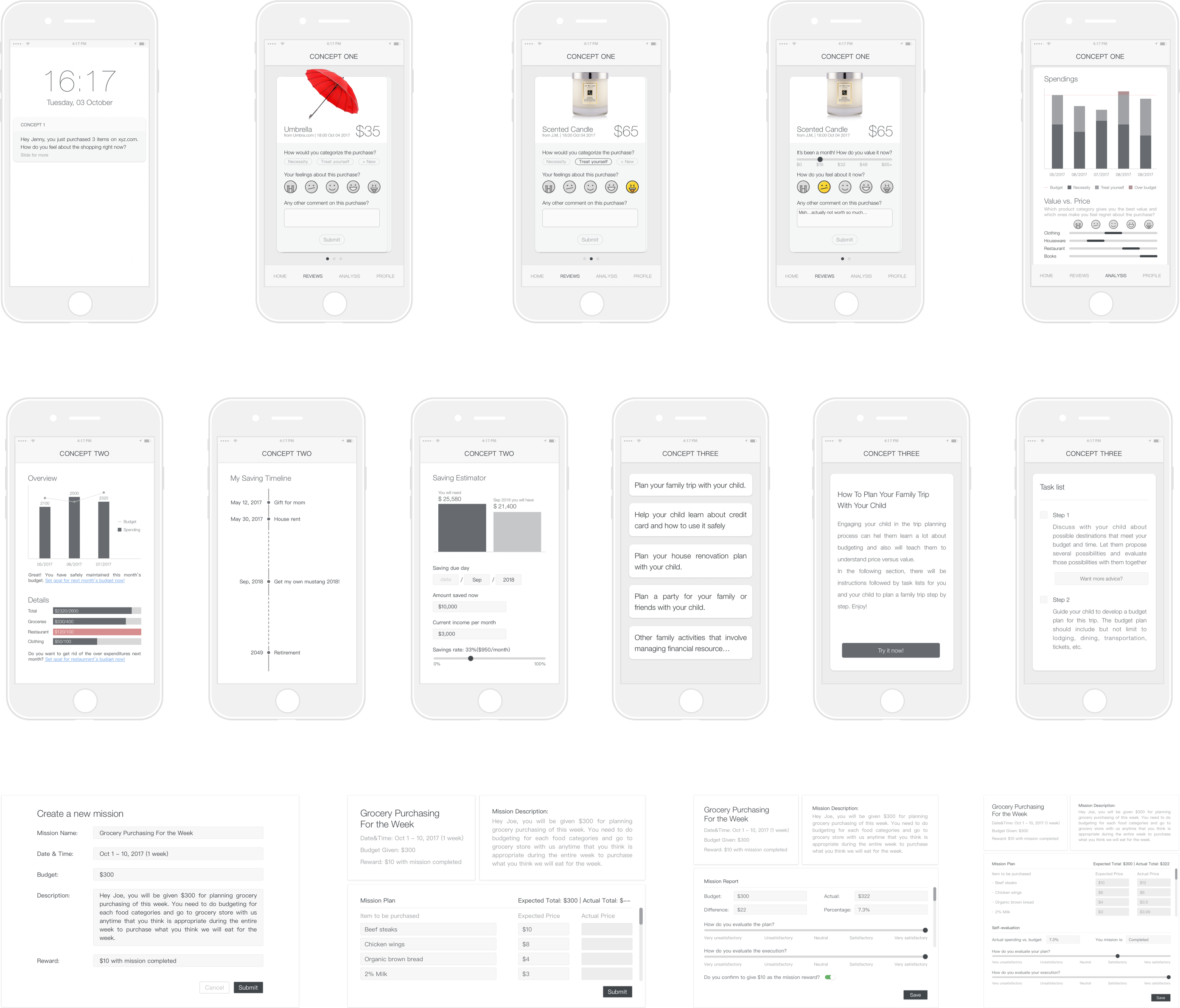

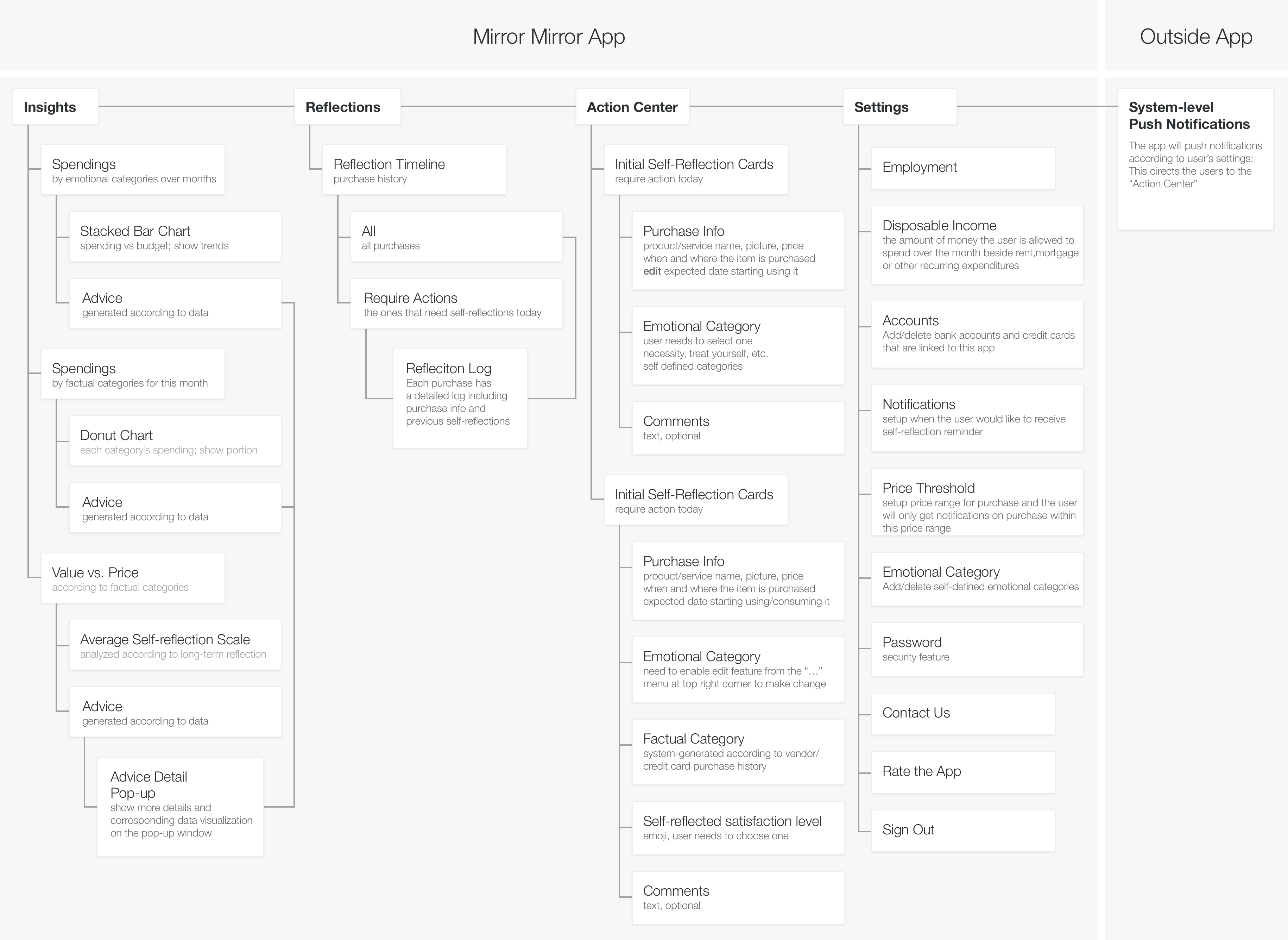

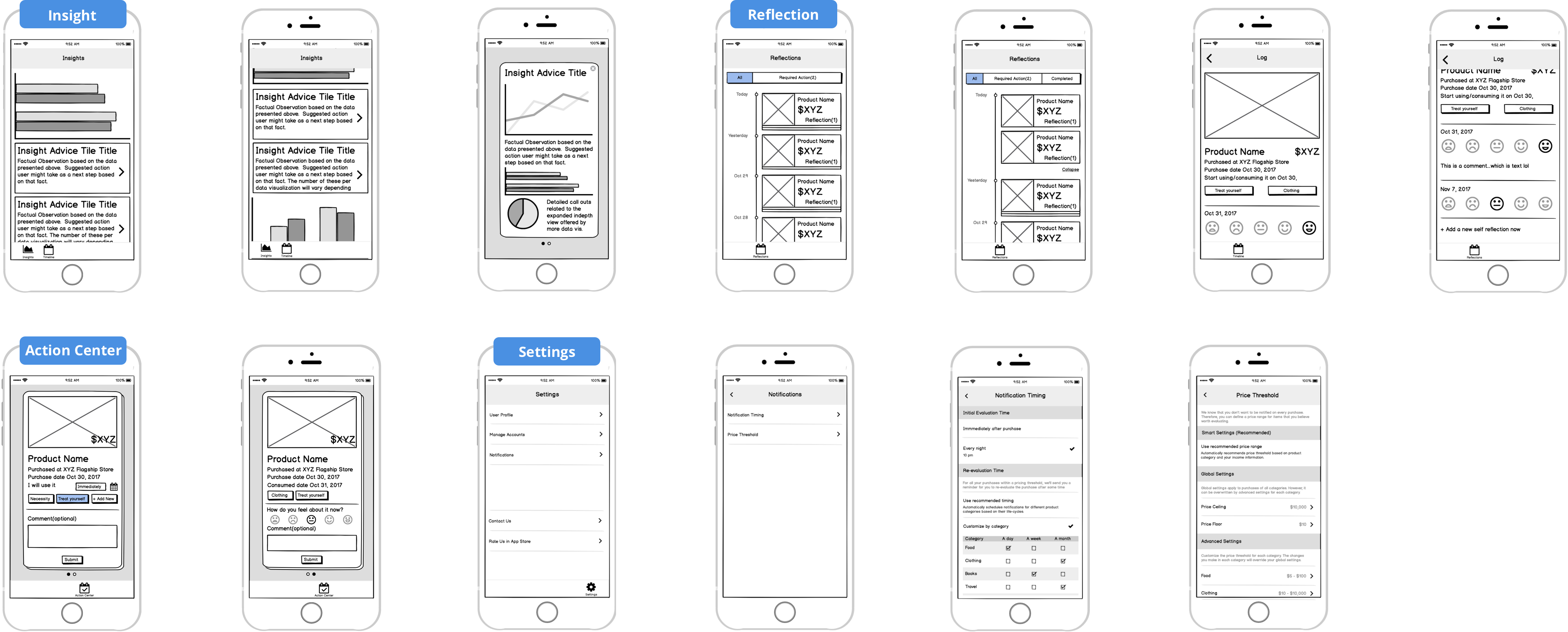

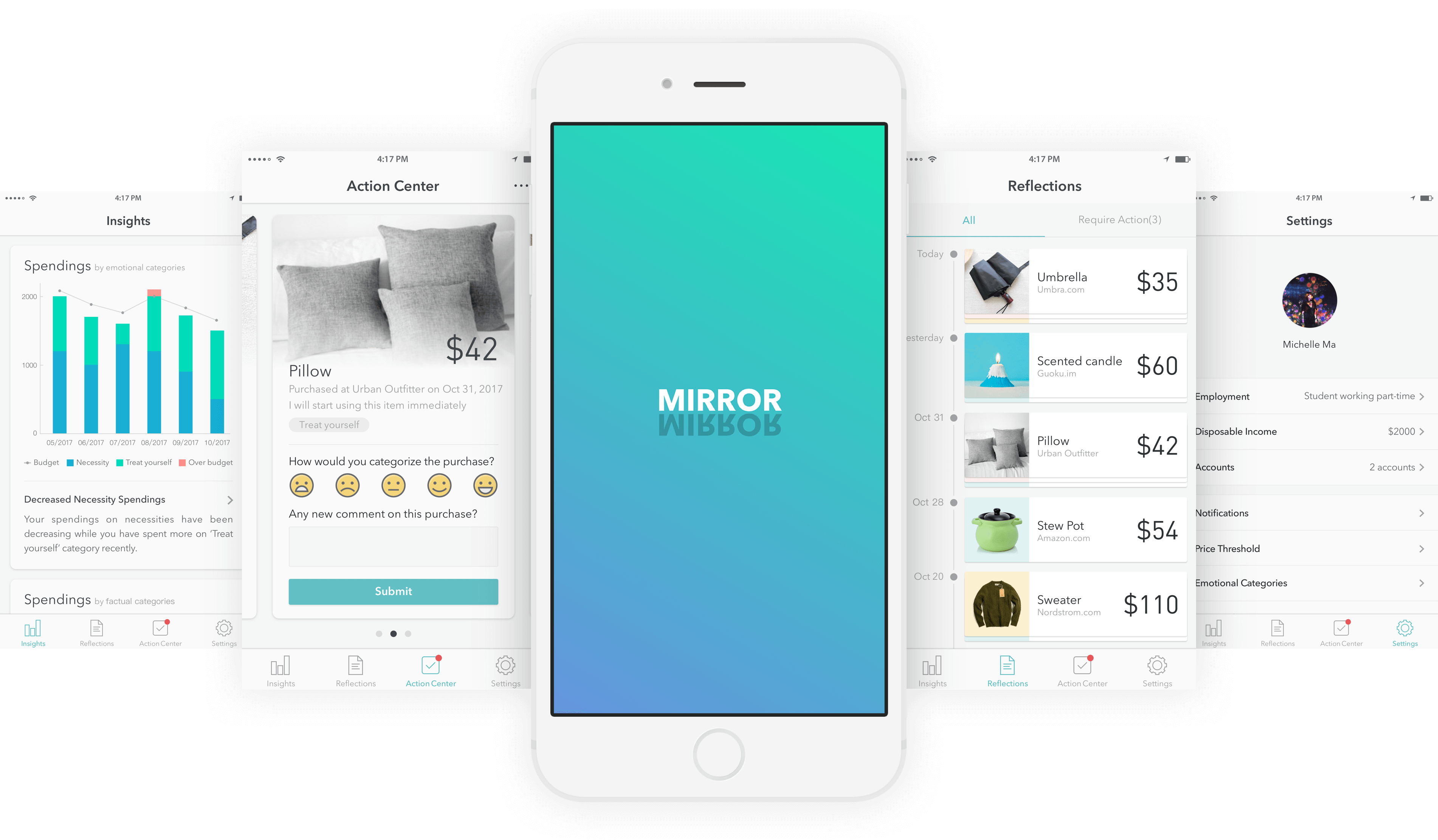

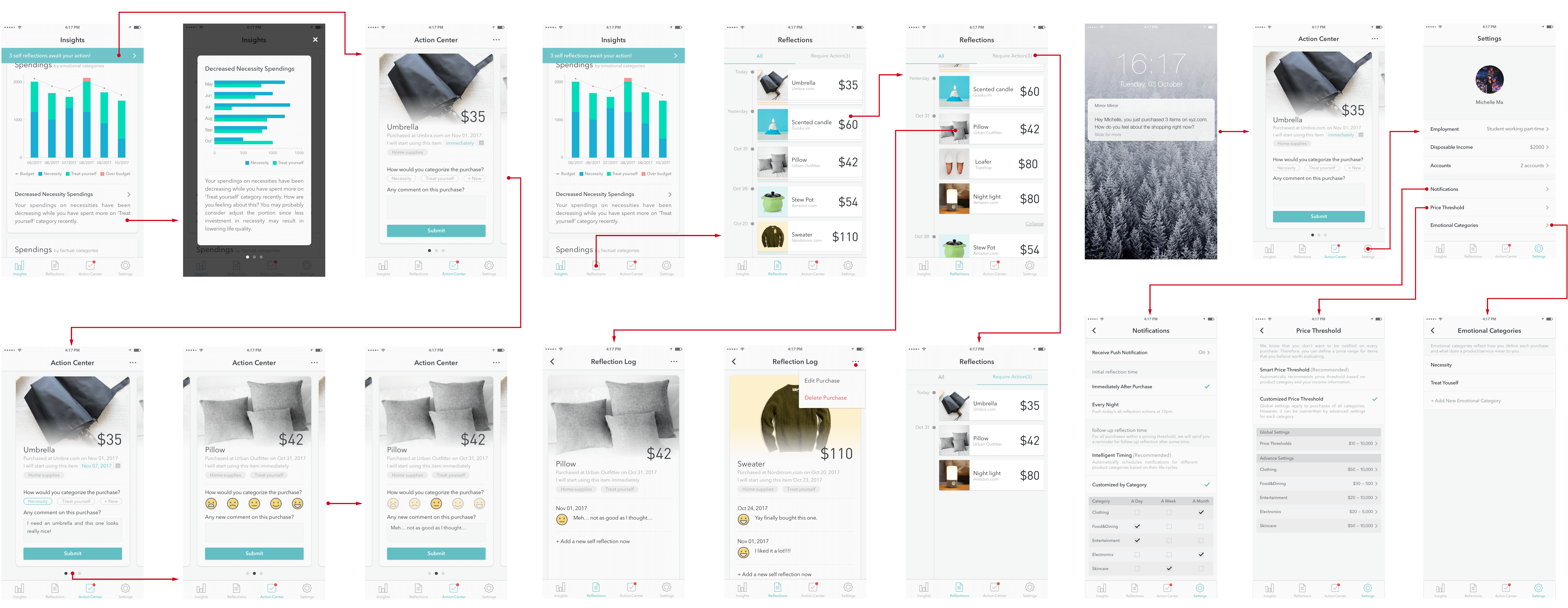

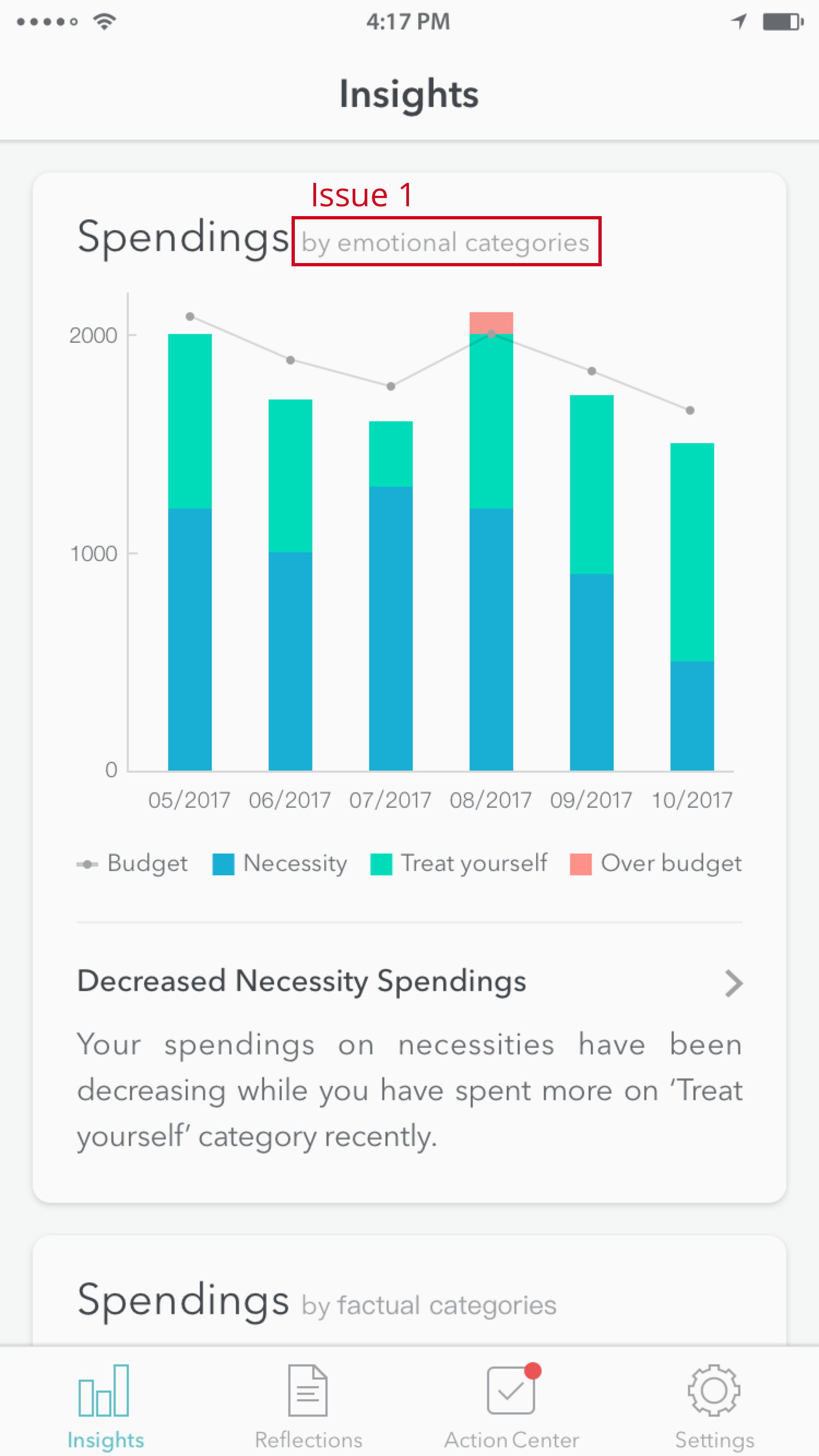

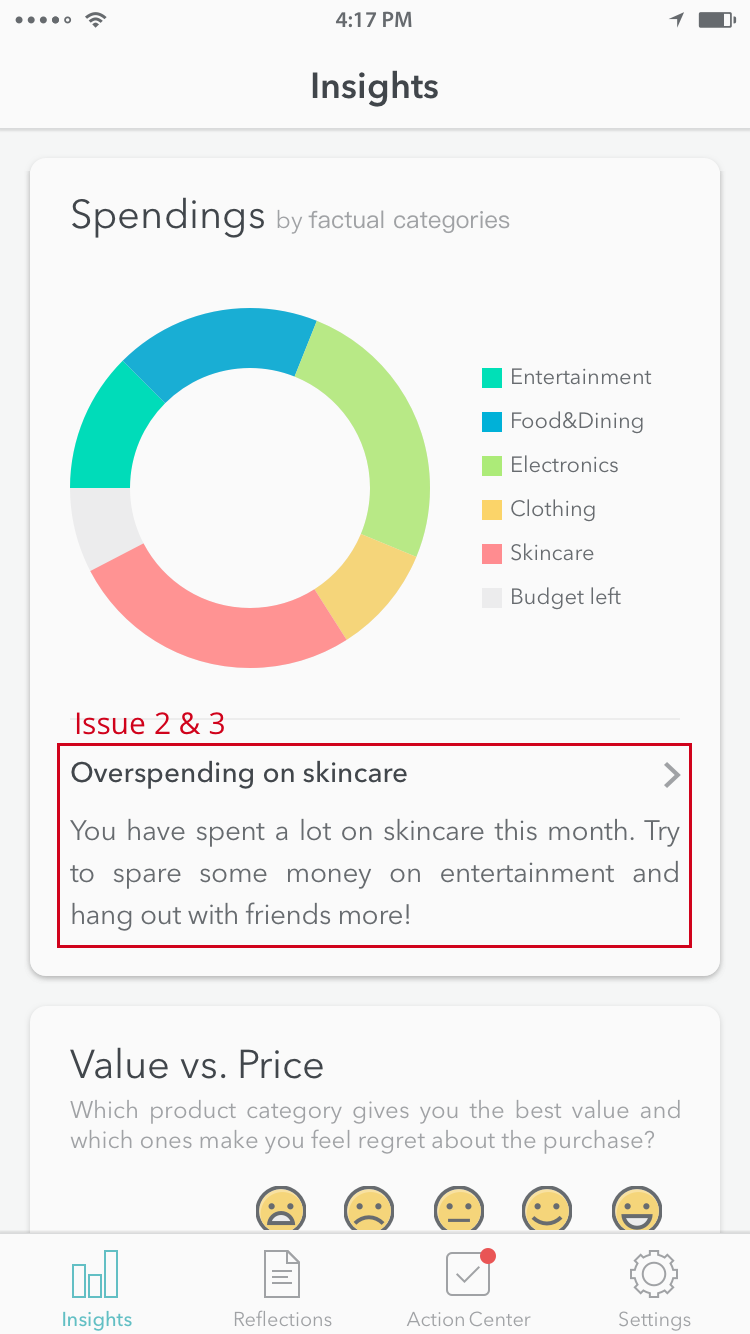

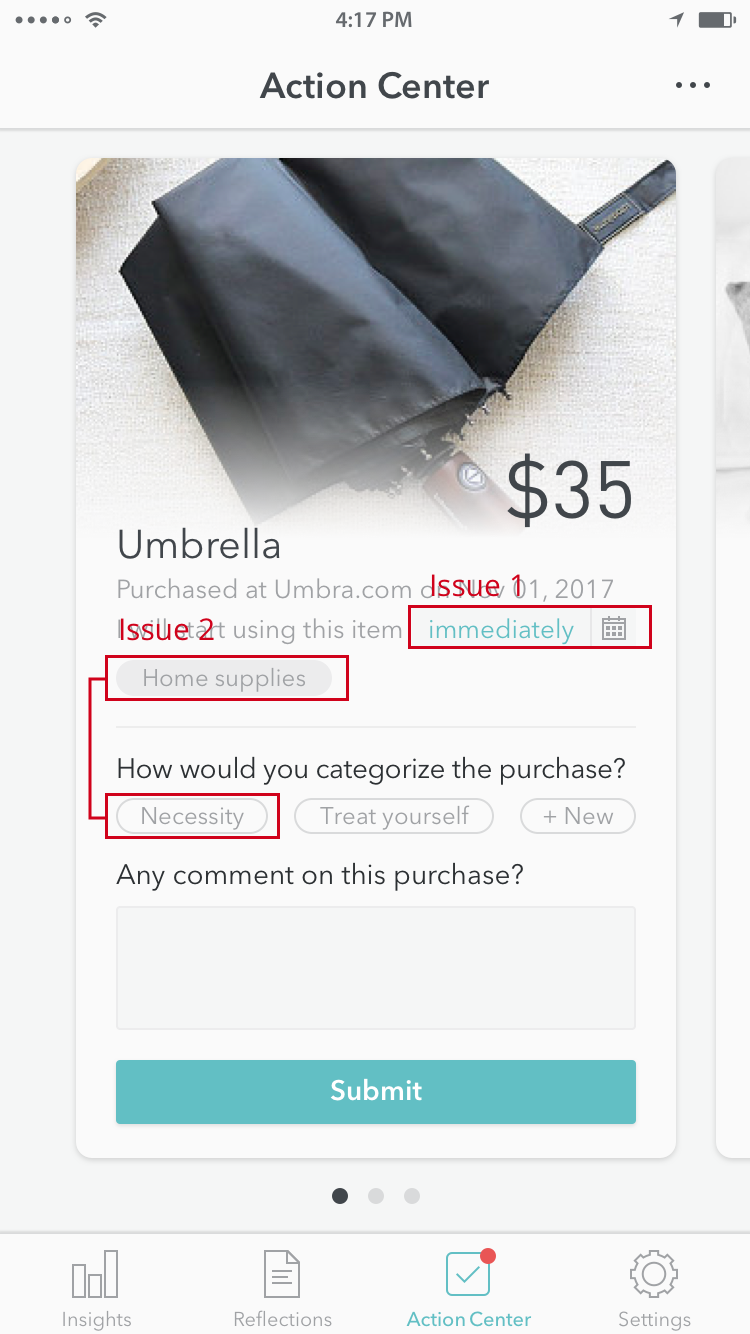

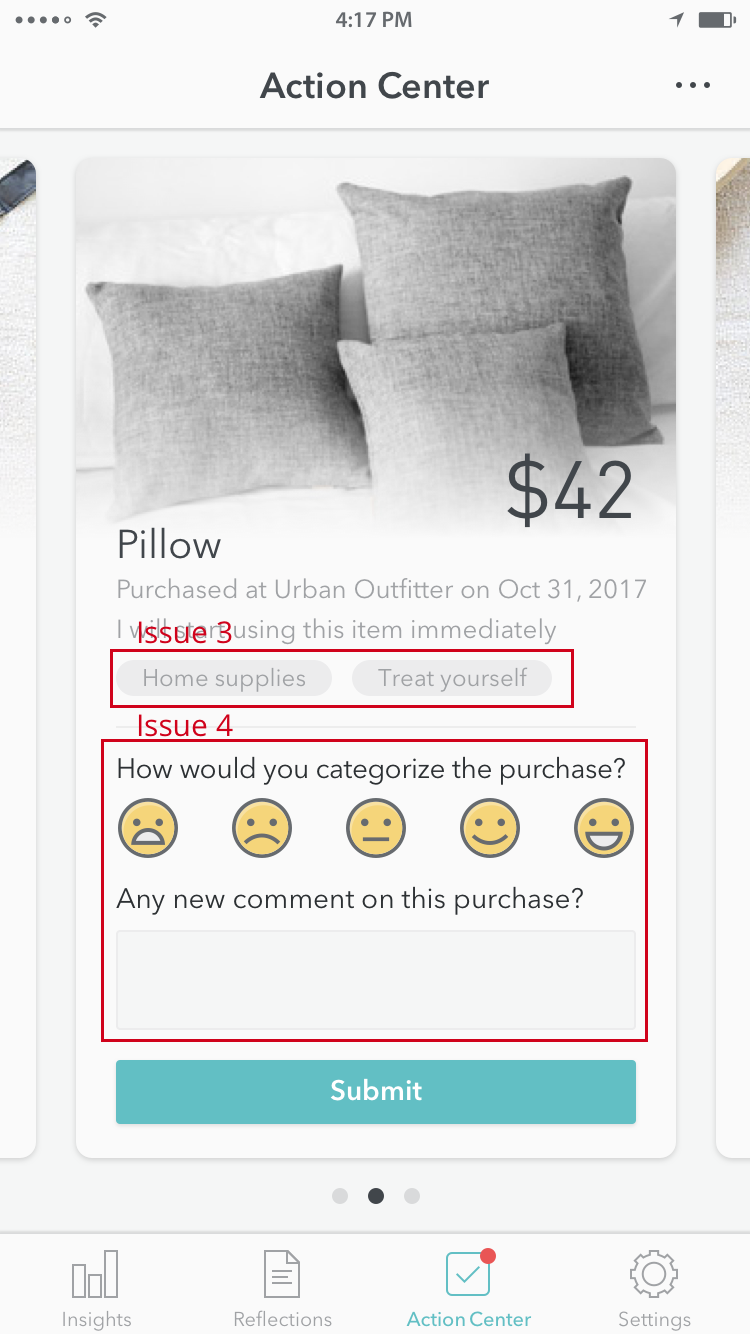

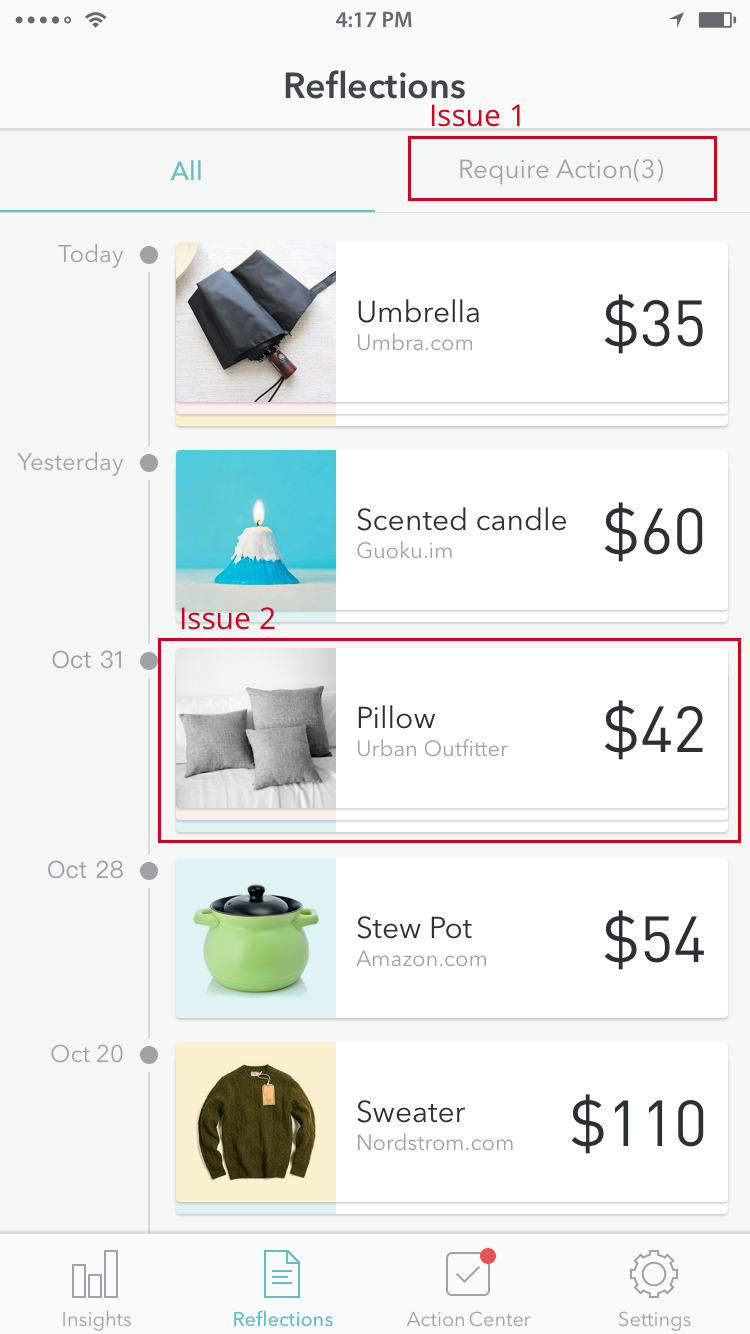

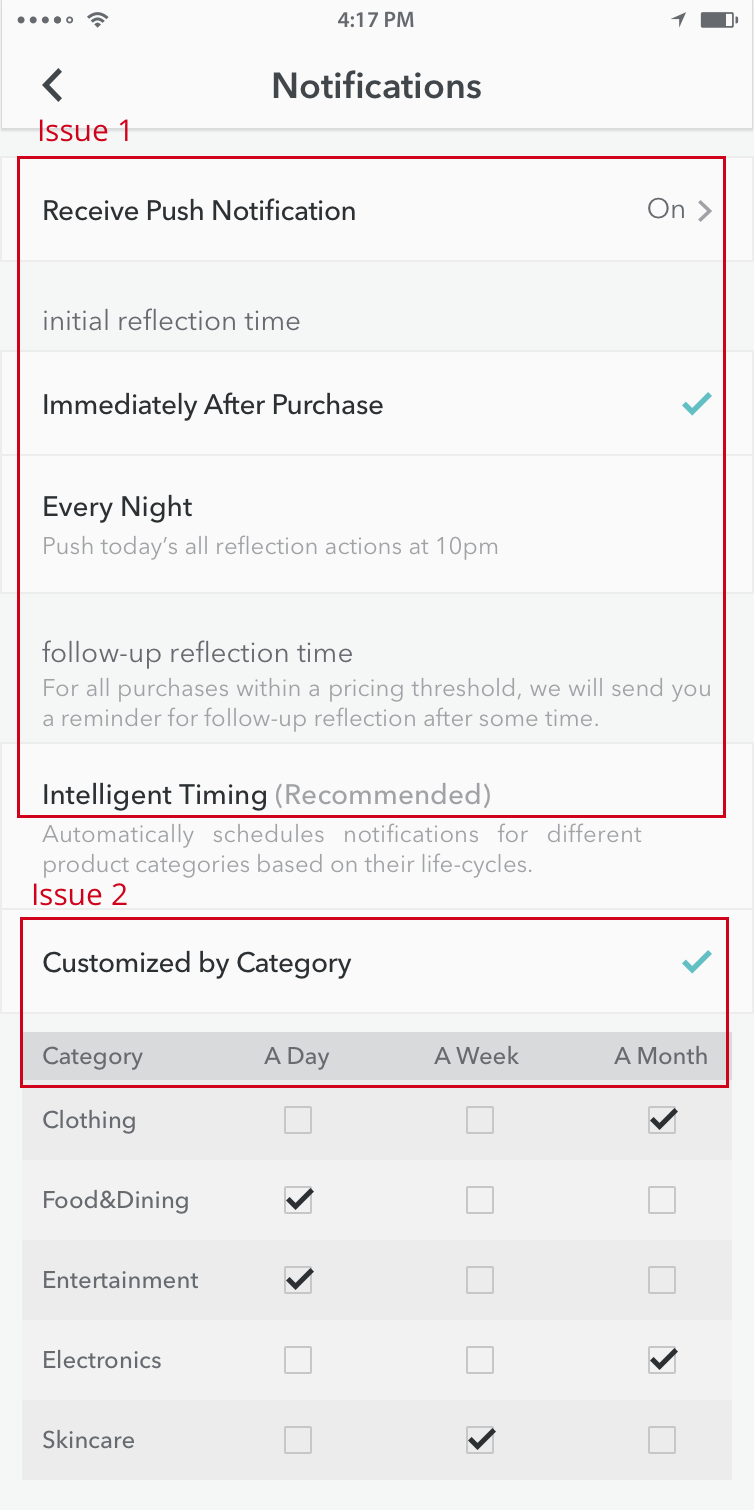

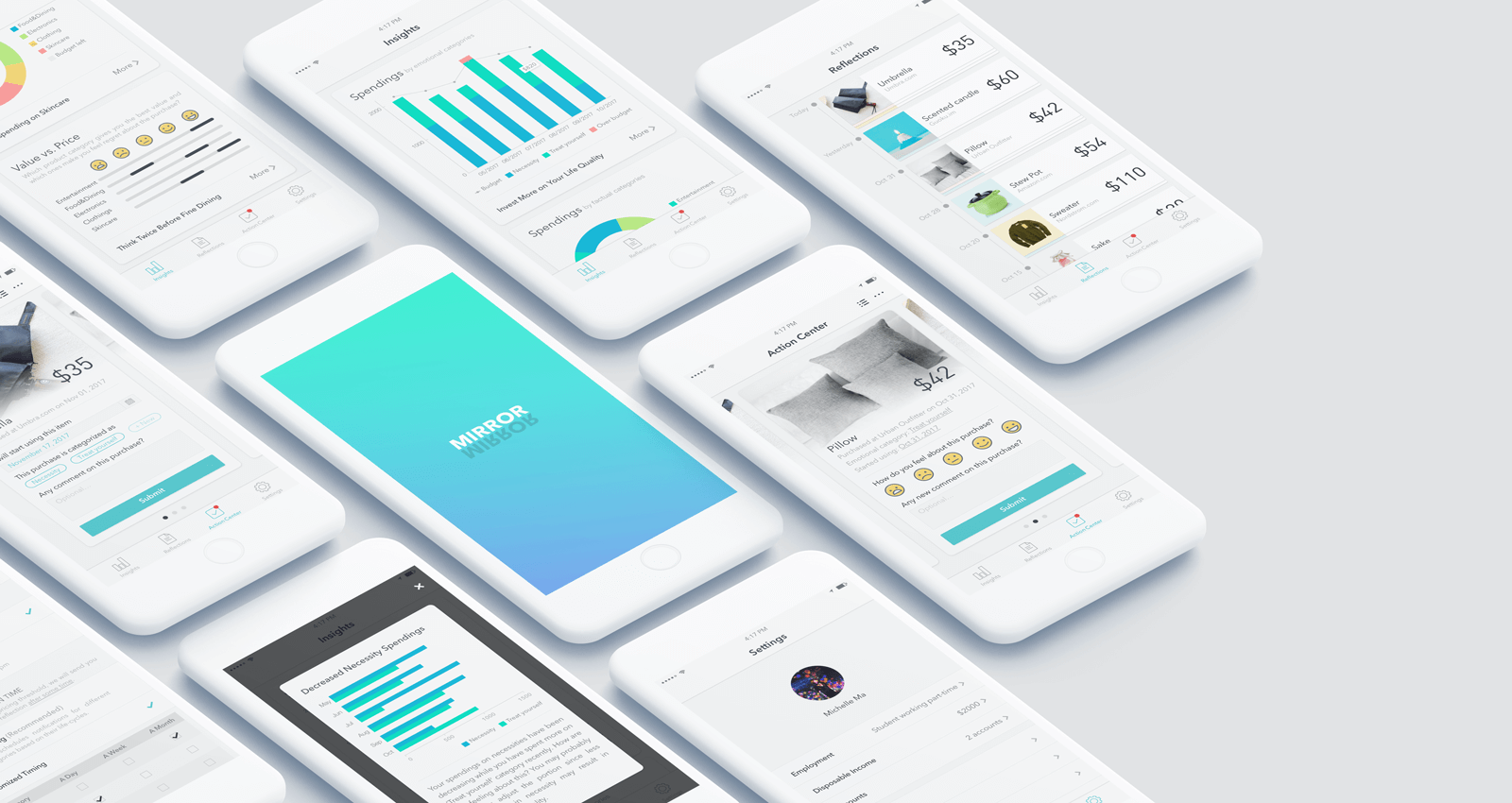

The application is meant to help emerging adults, those in their early to mid-twenties, reflect on the purchases they make to increase mindfulness of spending habits and allow them to make small changes overtime to improve their financial condition. This application will let you evaluate and categorize your purchase a short time after your purchase, and will encourage you to reflect on that purchase again a day, a week, or a month later depending on your preferences.

INFO

Category

- HCI Foundations Group Project @ Georgia Tech

Duration

- Aug. 2017 - Dec. 2017

Keywords

- UCD Process, User Research, Finance, Mobile App

Team

- Jason Paul, Michelle Ma, Sijia Xiao, Tony Jin

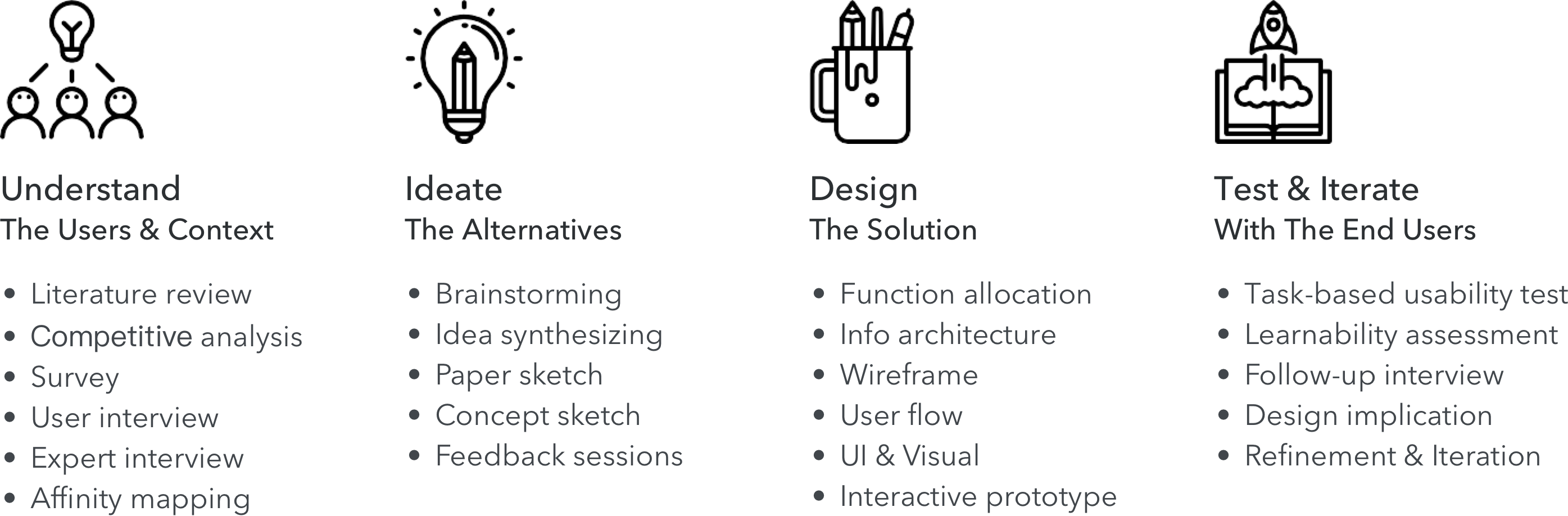

Research Methods

- Literature Review, Competitive Analysis, Survey

Semi-structured Interview, Task-based Usability Testing

Tools

- Paper and pen, Sketch, Balsamiq, InVision, Photoshop

PROCESS

MY ROLE

Research

- Conducted the competitive analysis; designed the survey and interview; conducted semi-structured interview.

Design

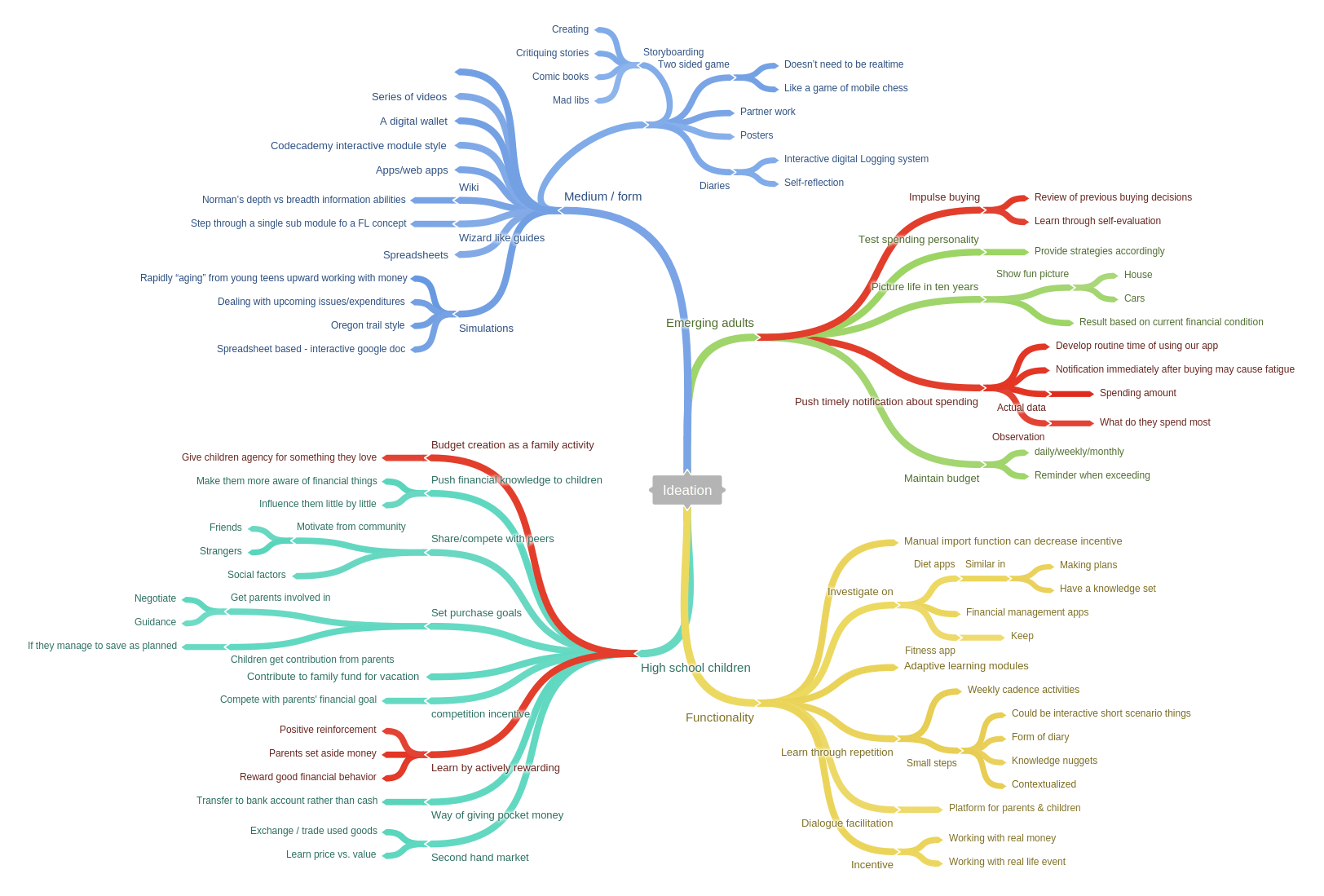

- Led the design phase including ideation, concept design and development; designed the user interface and crafted the interactive prototype; led the iteration.

Usability Testing

- Designed and moderated the task-based user testing session; qualitative data analysis, design refinement.